Did you catch that tiny record player zooming around vinyl discs on Shark Tank? That was RokBlok, the portable wireless record player that’s been turning heads since its TV debut. While music lovers debate its merits, investors are tracking its financial story. So what’s RokBlok really worth in 2025, and how did this palm-sized gadget build its fortune?

Let’s drop the needle on this fascinating business story.

RokBlok Net Worth

As of early 2025, RokBlok’s estimated net worth stands at approximately $5 million. This valuation represents significant growth from its humble beginnings as a crowdfunded project. The company has carved out a unique position in the music technology market by creating what many call the world’s smallest portable record player.

What makes this $5 million valuation especially impressive is the niche market RokBlok operates in. Unlike mainstream tech companies with broad consumer bases, RokBlok targets a specific audience: vinyl enthusiasts who want portability without sacrificing the analog experience.

Several factors have contributed to RokBlok’s financial growth. First, the ongoing vinyl revival continues to exceed industry expectations. Vinyl record sales have grown consistently since 2020, with particular acceleration during the pandemic when many rediscovered physical media. Second, RokBlok’s memorable Shark Tank appearance provided invaluable exposure that traditional advertising simply couldn’t buy. This visibility helped the company secure retail partnerships that expanded its reach beyond early adopters.

The company’s growth trajectory suggests that if current trends continue, RokBlok could see its valuation climb even higher by late 2025, especially as they expand their product line and enter new international markets.

Shark Tank Pitch to $5M

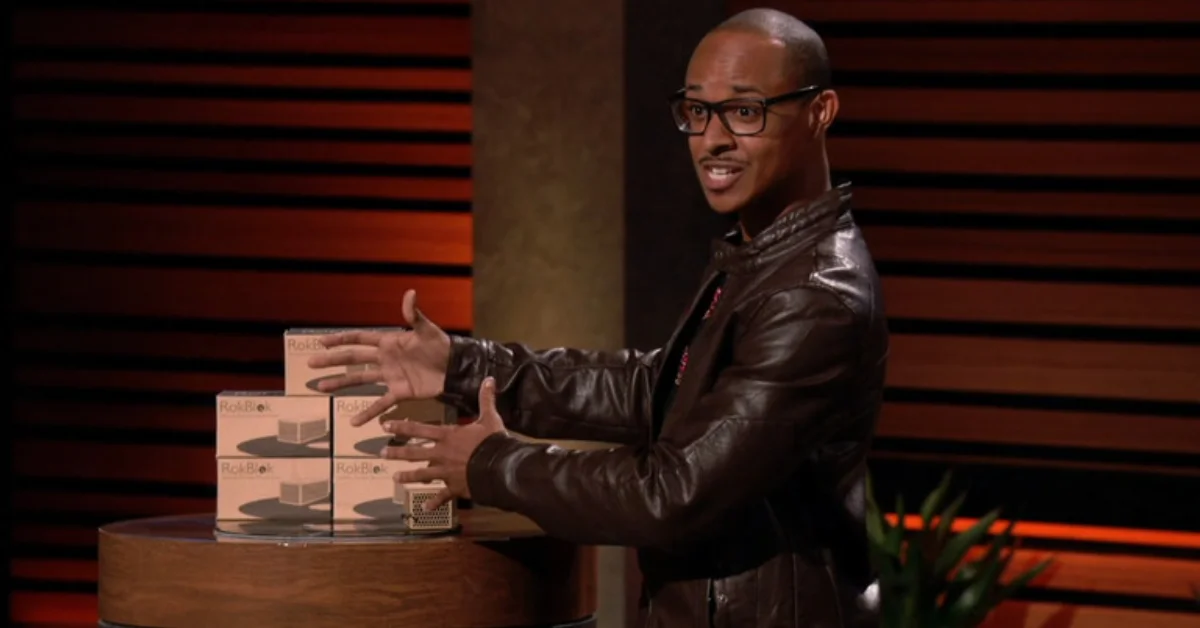

When Logan Riley stepped onto the Shark Tank stage in December 2017, he brought with him a product that looked so unusual some viewers thought it might be a joke. The RokBlok is essentially a small block that rides on top of vinyl records, containing both the needle and speakers needed to play music without a traditional turntable.

Riley asked for $300,000 for a 15% stake in his company, valuing the business at $2 million. His pitch highlighted how RokBlok solved a real problem for vinyl lovers: enjoying records without lugging around bulky equipment. The product retailed for $99, with manufacturing costs of $27.75 per unit.

The Sharks had mixed reactions. Some were concerned about potential damage to vinyl records, while others questioned the sound quality compared to traditional turntables. Robert Herjavec and Daymond John passed quickly, but Kevin O’Leary offered $300,000 for a $3 royalty on each unit until he recouped $600,000, then dropping to $1 per unit.

The game-changer came when Lori Greiner made an unexpected offer: $500,000 for 100% of the company. After some hesitation and negotiation, Riley accepted a modified deal: $500,000 for 100% with the condition that Riley would receive a 4% royalty on future sales.

Following the Shark Tank episode, RokBlok experienced the famous “Shark Tank effect.” Their website crashed from traffic surges, and they sold out of inventory within days. Though the final deal with Greiner reportedly underwent changes during due diligence (as happens with many Shark Tank agreements), the exposure proved invaluable.

By 2020, RokBlok had secured placement in Urban Outfitters and other retailers that cater to vinyl enthusiasts. The company expanded its manufacturing capacity to meet growing demand, and sales continued to climb despite the pandemic—perhaps even benefiting from people spending more time at home with their record collections.

Is It a Ripoff?

Not everyone shares enthusiasm for the tiny record player. Online forums, particularly Reddit’s r/vinyl community, have hosted heated debates about RokBlok’s value proposition and potential impact on precious vinyl collections.

The main criticism centers on record damage. Audiophiles argue that having a device physically ride on vinyl grooves accelerates wear and tear compared to traditional turntables where only the lightweight stylus makes contact. Some users have posted videos claiming to show microscopic damage after just a few plays.

Another common complaint focuses on sound quality. Critics point out that the small built-in speakers can’t possibly reproduce the full range that vinyl is capable of capturing. The company counters this by highlighting the Bluetooth connectivity feature, which allows users to connect to higher-quality external speakers.

Price-to-value ratio also draws criticism. At $99 (and higher for special editions), some vinyl enthusiasts argue you could purchase a basic traditional turntable for similar cost. The counter-argument from supporters is that RokBlok’s portability justifies the price—you’re paying for convenience, not audiophile-grade sound.

Logan Riley has addressed these concerns in interviews, explaining that the RokBlok uses a specialized stylus designed to minimize record wear. He also points to the patented design elements that distribute weight more evenly than might appear at first glance. The company offers a satisfaction guarantee and has published testimonials from customers who report no issues after multiple uses.

What’s particularly interesting about these controversies is how they’ve actually helped boost RokBlok’s visibility. The debates have generated millions of views on YouTube review videos and thousands of comments across social platforms—free publicity that’s contributed to the company’s growth.

How RokBlok Makes Money?

RokBlok has developed multiple revenue streams that contribute to its $5 million valuation. Understanding these income sources helps explain how a seemingly simple gadget built substantial worth.

The primary revenue generator remains direct product sales. At a retail price between $99-129 (depending on the model and special editions), and production costs now reportedly reduced to about $22 per unit, RokBlok enjoys healthy profit margins of approximately 75-80% on each sale. These margins exceed industry standards for consumer electronics, which typically range from 30-50%.

Retail partnerships form another crucial revenue channel. Beyond their direct-to-consumer website sales, RokBlok products appear in specialty music stores, Urban Outfitters, and select electronics retailers. While wholesale pricing reduces per-unit profits, the volume increase and brand visibility compensate for lower margins.

The company has cleverly diversified with accessories and complementary products. These include replacement styluses, protective cases, limited edition color variants, and branded merchandise. These accessories often carry even higher profit margins than the core product.

Licensing represents a growing portion of RokBlok’s income. The company has begun licensing its patented technology to other manufacturers for use in different applications. This creates recurring revenue with minimal additional production costs.

Special edition collaborations with musicians and record labels have proven particularly profitable. RokBlok has released limited runs featuring artist branding that command premium prices while generating publicity through artist social media channels.

The cost structure reveals smart business planning. Manufacturing has been streamlined since the early days, with component sourcing optimized to reduce costs without sacrificing quality. The company maintains a lean operational structure, with minimal physical office space and a strategic use of contractors for specialized roles rather than carrying large fixed salary costs.

Inventory management deserves special mention in RokBlok’s financial success story. Early production challenges caused fulfillment delays that frustrated early customers. The company learned from these missteps and implemented just-in-time manufacturing protocols that reduce warehousing costs while ensuring prompt order fulfillment.

Sustainable Growth

Looking beyond the numbers, RokBlok’s $5 million valuation reflects several sustainable business strengths that position the company for long-term growth.

First, RokBlok owns valuable intellectual property. The company holds patents on its unique design and functionality, creating barriers to direct competition. This protection allows them to maintain price points and margins without facing identical lower-cost alternatives.

Brand recognition provides another competitive advantage. The Shark Tank appearance created instant brand awareness that would have cost millions in traditional advertising to achieve. The memorable product demonstration—watching a small block race around a record—created lasting visual impact that continues to drive social media shares years later.

The company has demonstrated remarkable adaptability. When early production challenges threatened fulfillment timelines, management pivoted quickly to find new manufacturing partners. When audiophile criticism mounted, they responded with technical explanations and satisfaction guarantees rather than defensive posturing.

Conclusion

RokBlok benefits from minimal inventory obsolescence risk compared to other electronics. Unlike smartphones or computers that quickly become outdated, RokBlok’s functionality remains relevant as long as vinyl records exist. This reduces pressure to discount unsold inventory or continually redesign the core product.

The company’s lean operational model deserves special mention. With limited fixed overhead and an emphasis on direct-to-consumer sales, RokBlok maintains financial flexibility that allows it to weather market fluctuations while investing strategically in growth opportunities.

Customer loyalty indicators suggest strong repeat business potential. The company reports that customers who initially purchase RokBlok as a novelty often become advocates after experiencing its convenience. These customers frequently purchase additional units as gifts or upgrade to newer models when released.

Perhaps most importantly, RokBlok has created a product category rather than merely joining an existing one. By defining the ultra-portable record player segment, they’ve built brand synonymity with the concept itself—similar to how Kleenex became synonymous with facial tissues or Google with internet searches.

This combination of protected intellectual property, brand recognition, operational efficiency, and category leadership supports the current valuation while providing multiple avenues for future growth. For investors and industry observers alike, RokBlok demonstrates how innovation in a seemingly mature market can create substantial value.

As vinyl’s popularity continues its unexpected resurgence in our digital age, RokBlok’s unique approach to making records more accessible positions it well for continued financial success. Whether the tiny record player is judged by audiophiles as a gimmick or a revolution, its business performance speaks volumes about finding opportunities where others see limitations.